The Beer Market in Korea and The Expansion of Craft Beer

Source: pixabay

General Alcoholic Beverage Market

The trends and preferences on Korean alcoholic beverages have greatly changed over time. Before the year 2000, when people talked about having a drink, it was referred to as distilled soju, which dominated the domestic market. Drinking activity was focused on ‘Hoi Shik,’ late night business dinner gatherings involving consuming high alcohol by volume (abv) product. However, in recent years more people started to enjoy ‘Hon-sool’, or drinking alone, as well as alcoholic beverages with a lower abv, such as wine and beer. For various tastes and experiences, imported wine and beer consumption started to grow. Following this trend, the market share for beer increased.

-For more information on Hoi shik visit ‘The Death of Hoi shik’ https://ircconsultingkorea.com/market-insights/?board_page=2&vid=27

-For more information on ‘Hon Sool’ visit ‘Home-sool (drinking at home) or Hon-sool (drinking on your own)? https://ircconsulting.blogspot.com/2019/12/home-sool-drinking-at-home-or-hon-sool.html

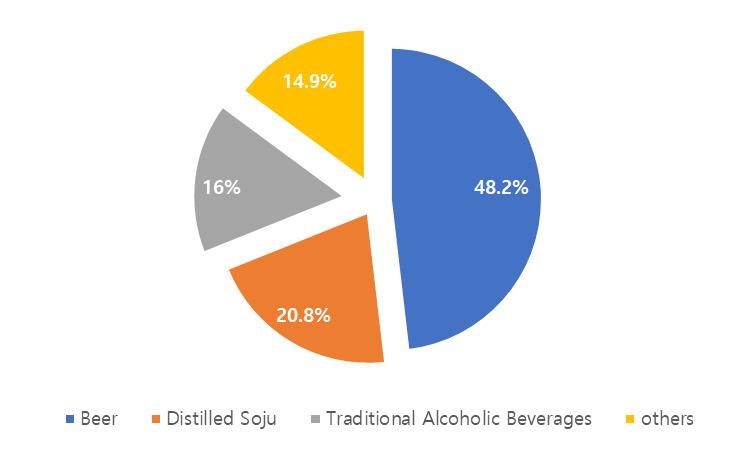

Based on a 2021 report by Korea Agro-Fishery & Food Trade Corporation (aT), we can observe the varying shares of different alcoholic beverages in the market with beer as the highest at 48.2%, followed by distilled soju at 20.8%, other traditional alcoholic beverages at16%, and others, such as wine and liquors, at14.9%.

Source: aT

Beer Market

Oriental Brewery dominates the domestic beer market, with brands that account for almost half the market share for beer in Korea. Hite Jinro, and Lotte Chilsung are the two additional largest domestic beer companies. Together these three companies account for over 80% of Korea’s beer market.

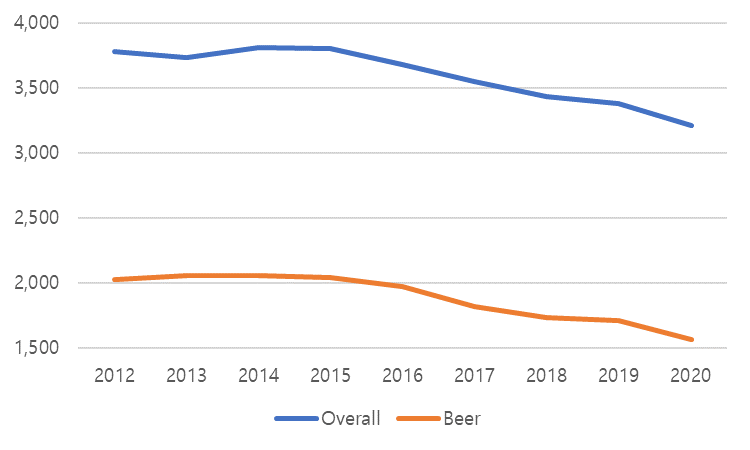

Since 2015, production has generally declined within the alcoholic beverage market, and the beer market also mirrors this trend. There are numerous assertions about why production and consumption have decreased, but rather than a single cause we believe it is due to a combination of factors. Some relevant factors include the increase in leisure activities that don’t involve drinking, an aging population that thinks more about their health and wellbeing and resultingly drinks less, and also recent government regulations such as the 2016 ‘Improper Solicitation and Graft Act’ which led to fewer instances of officially hosted dining and likely added momentum to the decline.

Production of Alcoholic Beverages

Source: Statistics Korea

Units: 1,000 kL

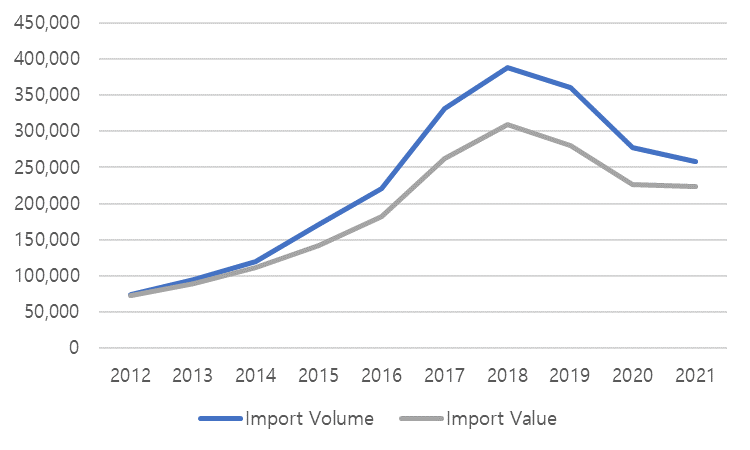

An increase in beer imports also contributed to the decline in domestic production since 2015. Within the imported beer sector, the overall value and volume of imports for beer showed a rapid increase beginning around 2014 until 2018, however these then started to decrease as well. Overall the beer market in Korea has maintained a downward slope.

Source: Korea Customs

Units: Tons / USD 1,000

COVID-19 and Korea’s social distancing measures affected many industries as well as people’s lifestyle and social choices. Likewise, the beer industry also experienced some significant changes during the pandemic. Before COVID-19, the B2C distribution channels for beer were experiencing only slow growth. After social distancing restrictions required bars and restaurants to close earlier than usual, ‘Home-Sool’, or drinking at home, effected a marked increase in the B2C market share. We can observe these changes through survey data from Trendmonitor comparing the location where beer consumption occurred in 2015 versus 2020.

Where Beer was Consumed

|

|

Home

|

Bar

|

Restaurant

|

Convenience Store

|

|

2015

|

68.7%

|

73.1%

|

61.1%

|

9.3%

|

|

2020

|

78.3%

|

61.3%

|

60.2%

|

12.3%

|

Source: Trendmonitor, with emphasis by IRC

The Rise of Korean Craft Beer

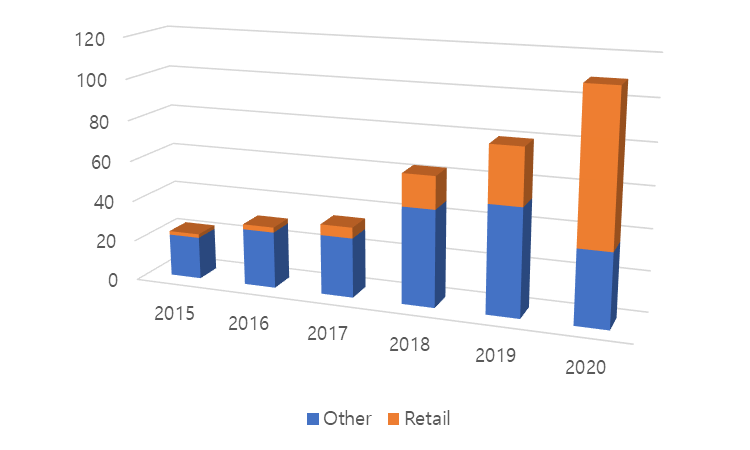

Not all Korea’s beer market sectors are in a downfall at present. In contrast to imported beer, the domestic craft beer segment started to enjoy rapid growth in recent years, although it still accounted for less than 3% of the total beer market in 2020. Consumers began to take note of craft beer in 2018 and it started with just 1.4% of the total beer market at that point. Soon afterward, with a boost in the numbers of microbreweries, the domestic craft beer sector started to grow. The impressive increase in the retail sector in 2020 is especially clear from the table below.

Craft Beer Consumption

Source: Korean Newspaper dongA

Units: KRW billion

In 2020 Korea changed its taxation of alcoholic beverages and craft beer production became more profitable. With that change, craft beer has come to represent over 20% of beer purchases in Korea’s convenience stores. With this development, major retail stores now also feature prominent displays of Korean craft beer brands, a practice that did not exist just a few years ago.

Source: Lotte mart April 8, 2022

During Korea’s recent political conflicts with Japan, Korean consumers boycotted Japanese products, including imported Japanese beers. This period created an opportunity for Korean craft beers to fill in these gaps as consumers and store owners rejected Japanese imported beers.

This craft beer expansion also resulted from Korean breweries' efforts that invested time, effort, and money to develop products, which are now counted as world-class craft beers. Korean breweries such as Jeju Beer Co., Amazing Brewery Company, and Kabrew are now exporting from Korea. Korean breweries are starting to win global awards for their quality craft beers.

While also experiencing this wider success globally, these domestic craft beer companies also focused on ways to better target Korean consumers. One of the primary trends developing is in the area of product collaborations. Beer manufacturers are teaming up with popular bar snack companies, legacy brand flour companies, and other consumer product companies, creating limited edition craft beers they produce only for a short period.

The enthusiasm of the domestic craft beer sector was evident at KIBEX 2022, Korea’s largest annual beer exhibition. While the three major beer companies Oriental Brewery, Hite Jinro, and Lotte Chilsung did not appear at the show, many domestic craft beer companies turned out to promote their products and discover new opportunities.

KIBEX 2022 – The 4th Korea International Beer Expo

Exhibition Information

March 31st ~ April 2nd, 2022

Coex, Seoul

https://www.beerexpo.kr/en_main/

Exhibit Categories:

Brewery (domestic and international), Distribution, Accessory, MD Products, Franchise, Raw materials / Ingredients, Subsidiary material, Food, Premium Beverages, Service / Education, Equipment / facilities

2020 Exhibition Statistics

- 130+ exhibitors

- 9,600+ visitors

The 2022 exhibition was fairly small compared to other major food and beverage exhibitions. However, KIBEX 2022 was well-attended, with excited visitors ready to sample and enjoy the exhibitors’ wares.

There were a great number of displays for imported beer brands from foreign countries, such as the U.S. and Canada, where attendees could taste foreign produced craft beers. The show’s highlight was the domestic craft beer companies providing their fresh brewed beer and their award-winning beers all in one place.

Various other booths displayed items such as brewery equipment, canning equipment, beer kegs, bar food and products from many other companies related to the beer industry.

For information regarding KIBEX 2021 or additional information on the Korean beer industry visit: https://ircconsultingkorea.com/market-insights/?board_name=board1&search_field=fn_title&search_text=beer&vid=29

|