Changes in Korea’s Cosmetics Industry

The 37th Seoul International Cosmetic & Beauty Expo

CosmoBeauty Seoul 2023, also known as the 37th Seoul International Cosmetic & Beauty Expo, was held at COEX in Seoul, Korea, from 25–27 May 2023.

Having first launched in 1987, CosmoBeauty Seoul has established itself as one of Korea’s more prominent trade exhibitions, focusing on personal care. Over the course of 40 years, it has served as a specialized showcase for Korea's beauty industry.

Despite South Korea being more hesitant than many other countries to ease away from its COVID-19 policies and restrictions, the event saw 260 companies participate last year in 2022. Among them, about 10% were foreign companies, indicating sustained interest in the Korean market from overseas businesses. By industry, the participating companies were 50% manufacturers, 21% distributors, 18% importers, 3% exporters, and 8% others. A total of 34,151 people visited the exhibition during its three-day run, indicating its scale.

Several trends were observable at the event. The strongest may be the growing global trend towards implementing responsible environmental, social, and governance practices in business, or ESG. Additionally, considerable emphasis is being placed on developing "vegan" products and eco-friendly packaging in the beauty industry. Clean beauty, vegan beauty, and the development of sustainable cosmetics are emerging as noticeable K-Beauty trends.

The Korean cosmetics industry’s reliance on the Chinese market

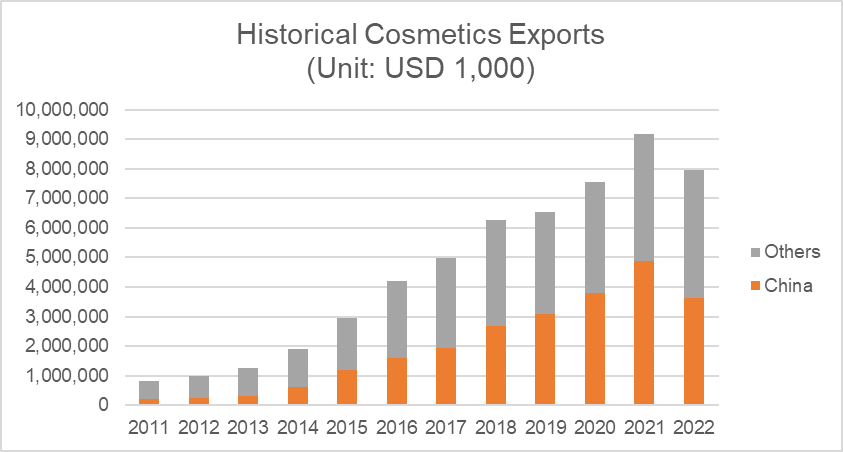

Less than $1 billion in 2011, South Korea's cosmetics exports grew to over $9 billion by 2021. To date, this growth trend has largely depended on the Chinese market. In 2020 and 2021, more than 50% of Korea's total cosmetic exports went to China.

However, the window on the Chinese market is closing. Korean cosmetics companies are beginning to face difficulties there. One key cause is the current political tension between Korea and China. For patriotic Chinese young people, South Korea is no longer a favored country. As Chinese consumers began to gravitate to Chinese cosmetic brands, sales of Korean brands in the Chinese market declined.

Aside from the impact of politics, the development of the Chinese cosmetics industry is another reason Korean brands are struggling in the country. Not only does China have the ability to manufacture cosmetics raw materials and finished products, but they also possess superior marketing capabilities towards Chinese consumers.

In short, the time when Korean cosmetics brands enjoyed an absolute advantage in China has passed. This is further reflected in the performance trends of Korea's leading cosmetics companies, LG Household & Health Care and Amore Pacific, both of which grew rapidly based on their sales in the Chinese market.

Stock Prices of LG H&H and Amore Pacific

Source: Google Finance

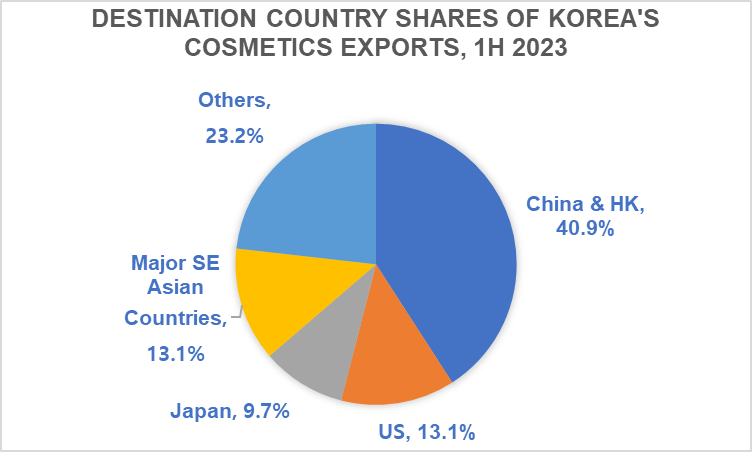

Due to its high proportion of China exports, it is unlikely in the short term that Korea's total cosmetics exports will recover the same level of growth. Overall, however, Korea's cosmetics exports are holding up well considering the decline in China-bound goods. This is because exports of Korean cosmetics are increasing to countries other than China, making up for the decrease in exports to China to some extent.

Trends in Cosmetics Exports by Country

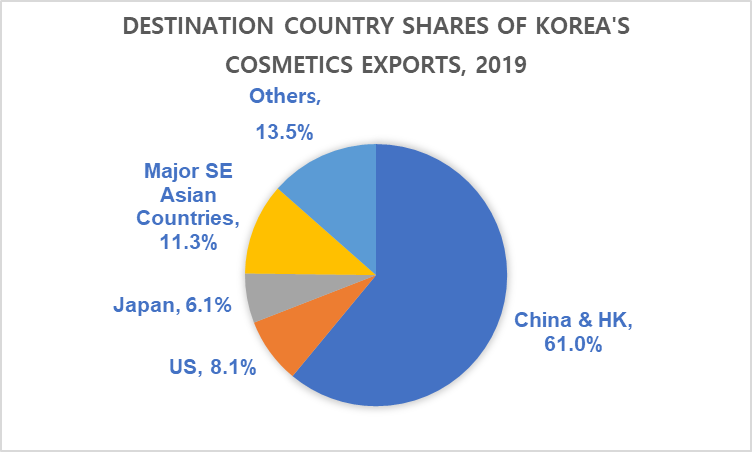

Compared to pre-pandemic years, Korea’s cosmetics exports to China, including Hong Kong, show a clear decline. On the other hand, exports to the US, Japan, Russia, and Southeast Asian countries show a rapid growth trend. The increase in cosmetics exports to these other countries is partially compensating for the decline in exports of Korean cosmetics to China.

Exports of Korean Cosmetics by Value

Unit: USD 1,000

|

|

2019

|

2020

|

2021

|

2022

|

2023 E

|

CAGR

|

|

China and HK

|

3,998,642

|

4,521,770

|

5,460,101

|

4,006,087

|

3,346,772

|

-4%

|

|

US

|

530,258

|

640,269

|

841,045

|

839,151

|

1,075,802

|

19%

|

|

Japan

|

402,417

|

639,218

|

784,119

|

746,075

|

790,920

|

18%

|

|

Major Southeast Asian Countries

|

736,371

|

774,740

|

827,434

|

963,639

|

1,078,574

|

10%

|

|

Russia

|

212,297

|

243,617

|

290,447

|

286,927

|

415,292

|

18%

|

Source: Korea Customs Office

Korea's cosmetics industry, which was overly dependent on the Chinese market, is diversifying its export markets to include greater sales to the United States, Japan, several Southeast Asian countries, and Russia. This strategic move reduces risk exposure to non-industry uncertainties such as geopolitical issues, which also means that the Korean cosmetics industry is becoming healthier.

Not only is the Korean cosmetics industry diversifying its export market reach, but the exporting company landscape is becoming more diversified as well. In addition to Amore Pacific and LG H&H, which have always been mentioned among leading players in Korean cosmetics exports, a wide variety of Korea’s small and medium-sized brands are achieving success in new markets.

New faces in the cosmetic industry

Young international consumers familiar with Korean dramas and K-Pop often seek out new Korean cosmetic brands. Among Japan's cosmetics imports, Korean cosmetics accounted for 23.4%, recording the highest share of the segment along with France. It’s worth noting that this figure does not take into account the amount that individual Japanese consumers directly purchase through internet shopping.

Most of Korea’s cosmetic export brands undergo precise planning and are launched with their specific target market in mind. Marketing methods are considered from the early stages of planning, and these efforts have translated into success for many newer brands within their targeted markets.

Source: Korea Customs Office, Compiled by IRC Consulting

In 2016, iFamily SC launched a color cosmetics brand, “rom&nd.” In 2017, the rom&nd brand recorded sales of KRW 700 million (appr. $530,000) and by 2022, its sales had grown to over KRW 80 billion (appr. $60.5 million). rom&nd introduced to cosmetics an aspect of fandom culture commonly used in K-Pop and celebrity marketing campaigns, where brand “fans” could communicate with the brand in product-focussed live sessions on social media and connect with fans in other Asian countries. Instead of spending marketing expenses on hiring large celebrities for advertisements, the rom&nd brand developed a sense of celebrity for itself. By communicating with fans using social media, they were able to successfully target a niche market by matching the increasingly segmented tastes and preferences of consumers. rom&nd releases about 70 new products every year. However, more than 80% of its products enjoy consistent sales. rom&nd explains that this is due to its efforts to read the needs and wants of its consumers.

Just as rom&nd utilized K-Pop's fandom culture, the spread of K-Culture is an inseparable ally for Korean cosmetic industry marketing. Young people in many countries around the world want to watch Korean dramas or singers' performances, achieve their “look,” and use the cosmetics they use. This aspiration leads to demand for Korean cosmetic brands.

The tenacious vitality of Korean cosmetic brands does not simply rely on their marketing capabilities. Korea has a manufacturing ecosystem with the capacity to progress products rapidly from planning to the production phase.

Strengths of Korean cosmetics development ecosystem

Approximately one third of cosmetics in the world are made in Korea. There are about 150 cosmetic manufacturers that produce products that can be exported to the global market with international certifications such as ISO22716, and there are about 4,000 cosmetic manufacturers in total.

Korea's cosmetics manufacturing system is flexible and efficient. A product that has completed design can be commercialized within one to three months. Korea's cosmetics brands have earned a worldwide reputation for quality and speedy, on-time delivery. Their impressive turnaround time in manufacturing capability includes not only cosmetic raw materials and finished products, but also includes developing new packaging.

Korean Cosmetics ODM, OEM Companies’ Continuing Growth

Unit: KRW, billion

|

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

Kolma Korea

|

1,358

|

1,379

|

1,322

|

1,586

|

1,866

|

|

Cosmax

|

1,260

|

1,331

|

1,383

|

1,595

|

1,600

|

Source: Financial Supervisory Service

Cosmopolitan Korea is a consulting service company that connects foreign cosmetics brands with Korean cosmetic manufacturers, leveraging Korea's cosmetics development and manufacturing ecosystem to offer a solution that enables customers from around the world to easily create the cosmetics they want. It not only provides services that connect Korean cosmetic OEM and ODM manufacturers with global customers, but also acts as an agent for licensing, customs clearance, and logistics procedures for target markets. The company's customers are distributed in more than 40 countries around the world, including the United States and Europe, as well as Asia.

Korea's cosmetics manufacturing ecosystem supports not only Korean cosmetics brands, but also cosmetics brands around the world. Korea maintains relatively reliable trading practices in terms of IP protection. In addition, it has both the physical and institutional infrastructure to support trade, such as having FTAs in place with 59 countries.

With a finger on the pulse of consumer needs and wants worldwide, the Korean cosmetics industry is pursuing new avenues to rival the cosmetic market offerings of other advanced countries, developing new products that incorporate ESG practices and vegan ingredients. The 2023 Seoul International Cosmetic & Beauty Industry Expo offered a clear glimpse of where the Korean cosmetics industry is heading.

|