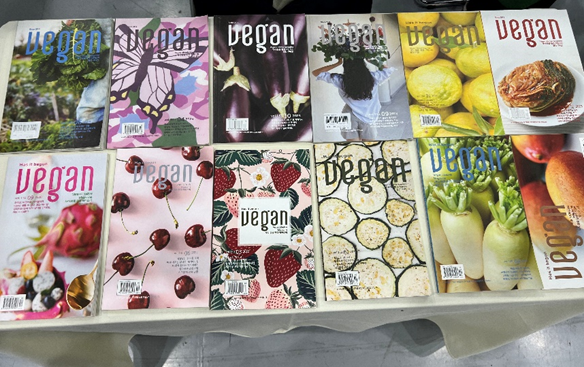

The Korea Vegan Fair 2024

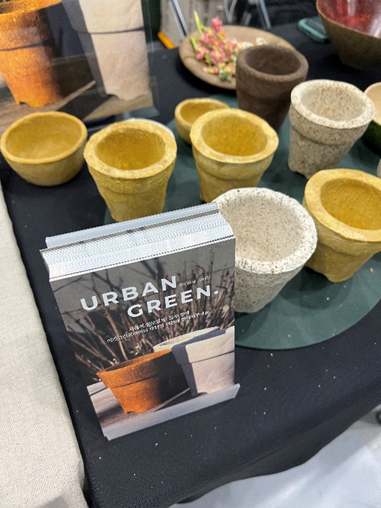

The Korea Vegan Fair 2024 was held from April 11th to 13th at COEX Hall B1 in Seoul. A total of 115 companies participated in the event, and around 14 lectures and seminars took place over the three days of the exhibition. The event showcased not only food items like vegan bakeries, beverages, and lunch boxes but also a wide range of companies offering eco-friendly household and lifestyle products. The effort to present various aspects of veganism was notable.

Source: Yonhap News (2024)

As global interest in ESG trends and healthy eating increases, various domestic startups, along with some major companies, are cautiously but curiously attempting to tap into Korea’s vegan market.

An industry insider stated that there are three main reasons why consumers turn to veganism: empathy towards animals, plant-based diets for better health, and environmental concerns. In line with these unified themes and objectives, the Korea Vegan Fair 2024 featured exhibits including vegan cosmetics, apparel, food & beverages, art pieces, and upcycled products.

In Korea, companies can obtain several different kinds of vegan certification, which allows them to use a vegan certification mark on their products. To promote their products as vegan, companies must undergo various tests, including verifying the absence of animal testing before they can receive the certification. The process requires regular renewals every one to two years, which some companies find quite demanding. An industry insider mentioned that changes and improvements in production processes likely necessitate regular updates and inspections. Despite a demanding certification process, the vegan market in Korea is growing steadily, albeit slowly.

Vegan Certification Logos of Various International Entities

Source: Google

An industry expert who participated in the exhibition noted that the Korean vegan market is still in its very early stages, which makes reliable official statistics on vegan-related matters scarce. According to the expert, the vegan population in Korea, including flexible vegans (e.g., general vegetarians and selective vegetarians), is estimated to be around 4 to 5 million people, accounting for about 8-10% of Korea's total population of 51 million. The figures likely include purchases by non-vegan consumers who seek vegan products as a healthy food alternative. According to the Korea Vegan Union, as of 2022, the vegan population in Korea was about 4% of the total population, amounting to about 2 million people. This proportion seems to align with that of other regions like Europe or the US, where the vegan population is known to be about 3-4% of the total population.

According to the Korean online economic journal Ezyeconomy (link), the vegan market in Korea shows distinctive growth compared to China and Japan within Northeast Asia. The reason is that China has a clear preference for animal-based cosmetics and Japan's preference for a diet including fish and meat slows the spread of veganism, argues the representative of Vegan Society Korea. Additionally, a cosmetics industry exhibitor at the Korea Vegan Fair 2024 mentioned that in Japan, the regulatory environment for vegan products is not as established or strict, making it less challenging to operate a business and suggesting weaker consumer interest in such products. Furthermore, he claimed that Japanese consumers don’t provide much feedback or many complaints about products, making Japan a less ideal market for businesses that are eager to learn from consumer voices and incorporate this feedback to improve their products. In this developmental stage for the vegan market businesses must decide where to enter East Asia, and how they set up their market entry strategies will depend on their needs and targets within a given country.

While the vegan market in Korea is still in its nascent stages, these differences with neighboring markets highlight the unique advantage the country offers as a test market for international businesses looking to expand into East Asia. This advantage is augmented by Korea's rapid adoption of global trends and a consumer base that is open to new and innovative products. Businesses considering Korea as a test market can tap into a knowledgeable and trend-sensitive consumer base to refine their offerings before scaling up to larger, more competitive markets.

Various companies exhibiting at Korea Vegan Fair 2024 reported that although the Korean market is very small, the clearly defined target consumer group demonstrates high customer loyalty as indicated by a high “product repurchase rate.” This has led to steadily increasing sales. The fair featured a range of consumer products including vegan pet snacks, vegan ice cream, vegan Ready-to-Drink (RTD) beverages, meat alternatives, and plant-based cosmetics. Most exhibitors have entered the vegan market relatively recently, with the earliest entries in 2021 and the latest in 2023. Given that the market is still in its infancy, making demand predictions is challenging, and some companies lack confidence in their ability to persuade consumers to spend. As a result, rather than starting by exclusively selling vegan products, a number of them have introduced vegan products by simply adding them to their existing product lines.

The show included as participants several major Korean food and beverage companies (e.g., CJ CheilJedang) and companies that sell common and popular brands in Korea, such as Pocari Sweat and Demisoda. They are diversifying their product lines to include vegan-certified options, aligning with global trends. There were also a number of small companies present and worthy of note. “Nice Kekki,” a vegan ice cream startup that uses 100% plant/grain-based ingredients, launched its product less than a year ago but has already started distributing through major domestic online/offline retailers like Coupang and Seven-Eleven.

Although the vegan market in Korea is still categorized as very early stage, there is potential for explosive growth at some point if situational factors and Korea's trend-sensitive culture align well. Some companies are already positioning themselves to dominate the market for that time and are expanding their vegan products in line with global trends. While the absolute market size is not as large as in more strongly 'Green-focused' nations, the visible efforts of companies striving to capture the market are evident.

As a Korea-focused business development consultancy in Seoul since 1982, IRC Consulting has over 40 years of experience assisting foreign organizations to identify and pursue commercial opportunities in this distinctive market. Employing first-hand knowledge and expertise, IRC stays on top of emerging trends to provide market entry related services including trade show representation, market opportunity assessment, partner searches, and entry strategy implementation in a variety of sectors. When considering Korea for your business expansion goals, let IRC guide the way.

|